This article is one in a long series which I hope will help explain the ins and outs of DFA – Dimensional Fund Advisors. NOTE: This is my interpretation and explanation only. For the final word, please refer to the DFA Canada Website.

Criticisms of The Initial Findings

As noted at the end of Part X, there were some early criticisms of the Three Factor model after the publication of the paper The Cross-Section of Expected Stock Returns in 1992. (As an aside, I understand that this paper has been the most cited finance paper in the last 20 years.)

One of the main criticisms has been that Fama and French were simply data-mining. After all, the paper had only looked at the period from 1963 to 1990 and only at the US stock market. Some argued that with all the academics sifting through the reams of data on the markets it’s only natural for someone to find some patterns that work really well, but have no real explanation other than ‘it was observed’.

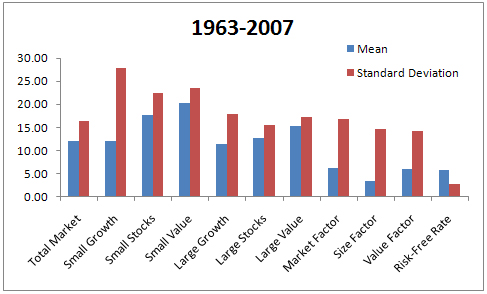

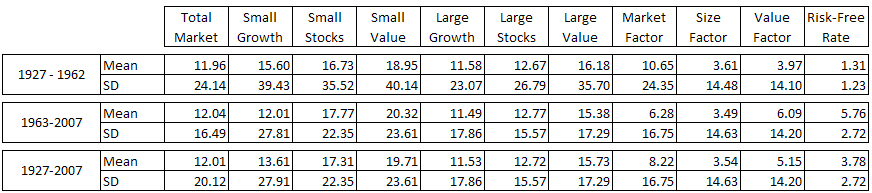

To address the short sample size, when the data was available going back to 1927 the same analysis was done and the results even more robust. (I don’t have the R² numbers for the 5×5 matrix of the market for the Three Factor model on hand, but here are the summary statistics for the annual returns for the market and different sections of the market.) I have included this data which was provided by Eugene Fama and DFA (ditto goes for all other data in this part). The original data from 1963 to 1990 was extended to 2007, and 1927 to 1962 was analyzed separately and then finally all the data from 1927 to 2007 was looked at as well:

For those who are interested, here are the numbers in table form, which you can click to enlarge:

One thing to note is that Small Growth seems to have anamolous results with respect to the standard deviation numbers. It would seem that investors in small growth stocks do not get as fairly compensated for the risk they are exposed to compared to other sections of the market.

But What About Different Markets Altogether?

Okay, so we’ve seen some data from an earlier time period and the results were basically in line with the theory, and of course looking at both the original time period and earlier time period and then adding on the data for recent history also showed that there seems to be size and value premia.

…at least for the US market. But what about other markets?

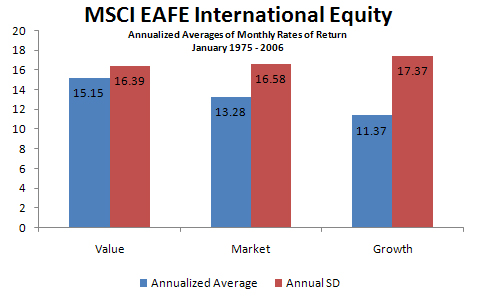

According to William Bernstein, “Value and size premia were found on every hill and under every rock.” You can read his full article which commemorated the 10th anniversary of the now famous Fama French paper by clicking here. Note that he also provides some hints as to how a non-DFA investor might take advantage of these premia, which I will also address later in this series. But for those who are satisfied to stay here and look at more charts, next up is some data for the MSCI EAFE index:

Followed next by some data on Emerging Markets:

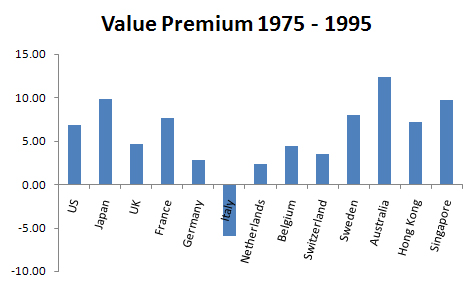

And finally, here are the observed value premia for 13 individual equity markets from 1975 to 1995.

A value premium shows up in 12 of the 13 markets with the exception of Italy. I will add that in 1975 there were only 72 companies in the Italian equity market sample and it had an annual standand deviation of 43.77 during this time. (Many of the other markets had few companies in their public markets as well, and the reasons for not seeing a value premium in Italy could also explain why we see a value premium in those other markets to be fair: the time and size of those market samples are relatively small.)

Okay, I think I’ve bombarded you with enough charts for one sitting. Hopefully this isn’t getting too boring. In Part XII we will look at how the Three Factor Model has crept into the world of retail financial services and this will be a bit more interesting.

I’m waiting with baited breath for more articles on Dimensional, keep up the great work Preet!

@Jordan – Sorry for the delay, I needed a break! :) Today is already booked up until close to 10pm, so I won’t have time to sit down and write the next DFA post until tomorrow (they tend to take more time than other posts). But I will continue this week for sure!

No worries it takes time, I just wanted to give you some encouragement and to let you know I for one have really appreciated reading all of the past articles.

@Jordan – My 8pm canceled so I had time to write a DFA post – just for you! Enjoy! :P