Mutual Fund Fees Over 25 Years… Ouch

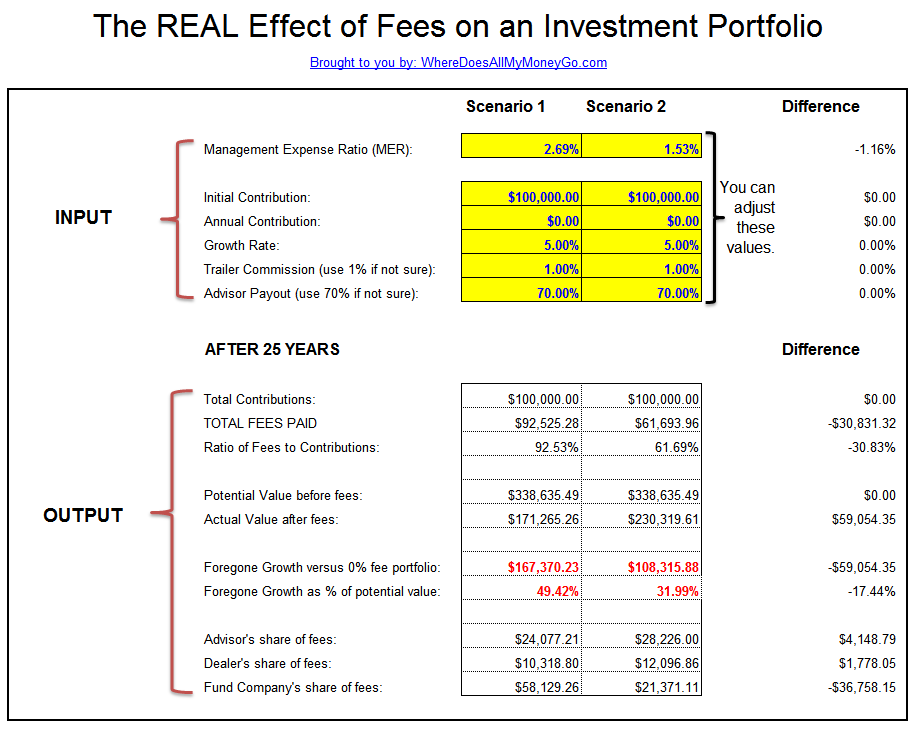

I put together a spreadsheet that will help people really quantify the effect of fees on a mutual fund over a long period of time for investors. It also shows you exactly how those fees are divvied up between your financial advisor, his or her dealer and the mutual fund company. You can make a side by side comparison of two different scenarios so you can see a fully advised, actively managed option versus a DIY, couch potato option, and everything in between. Here’s a screen shot (or download the spreadsheet here: The Real Impact of Fees on Most Mutual Fund Investors):

Over 90% of contributions consumed by fees?

In this particular example, a 2.69% MER mutual fund consumed 92.53% of your original contribution over 25 years and left you with 49.42% less money due to the effect of fees. Now, keep in mind you won’t be able to eliminate fees completely so comparing this to a 0% fee option is best used for comparison’s sake. For example, a 1.53% fee option still consumed 31.99% of your “potential” portfolio. However, you would’ve been almost $60,000 richer after 25 years and an initial $100,000 contribution. You also saved over $30,000 in fees. Now you see why DIY couch potatoes are so adamant about low costs. Download the spreadsheet and plug in a couch potato MER of 0.25% – 0.40% and see the effect. Yikes.

Of course, as I’ll mention below, saving 1% by firing your financial advisor can cost you more than 1% in performance and bad financial planning decisions. The majority of people still need an advisor for asset allocation, discipline and financial planning (insurance, estate, tax planning etc.).

MERQ – Management Expense Ratio per Quarter century

The numbers chosen were based on the Canadian Capitalist’s recent post in which he suggested that investors can retain a financial advisor and lower costs by using a financial advisor who uses cheaper funds with similar mandates. (Many financial advisors today are using passive portfolios and focusing more on the financial planning.) Specifically he compared a fund with a 2.69% MER versus a commensurate iShare exchange-traded fund (ETF) with a 0.53% MER and then added a 1% annual financial advisor fee to make a fair comparison.

Michael James on Money had a great post on a hypothetical metric that would emphasize the parasitic drain of Management Expense Ratios over time, something he called the MERQ – or Management Expense Ratio per Quarter century. Using the Canadian Capitalist’s example of a fund at 2.69% versus a 1.53% solution, the MERQs were 49% and 32% respectively. You’ll see the same results in this spreadsheet, but with the additional ability to plug in specific dollar amounts and to also factor in annual contributions as well.

The above posts were all sparked by Jonathan Chevreau’s recent commentary on financial literacy as it relates to financial services profits. To put it gently, it kinda exploded after that.

I agree that fees are extremely important, but there is more to the entire conversation than just that. Recently Dan Hallett, Director of Asset Management at HighView Financial Group added his two cents in a piece called Mutual fund critics missing the big picture. More and more, investors and financial advisors alike are beginning to believe that the true value add from an advisor is the financial planning.

Watch this space…

Right now, the calculator assumes that the financial advisor chooses only to use a Fee-based model or use a Front-End mutual fund with a 0% upfront commission. In the real world, some financial advisors may use Deferred Sales Charge funds or Low-Load Funds as well. This will change the calculation of fees directed to the advisor and dealer. I’ll build the ability to differentiate between commission models in a future version of the calculator. This will include choosing a fee-only option as well.

Final Points

I do want to point out what I think are some salient points:

- In the above example, the investor AND the advisor take home more money when product cost is reduced (all other things being equal). This is again because the lower cost reduces the drag on compounding returns. It’s win-win. Lower costs via indexing means lower revenue to the fundco’s, but index fund manufacturer’s know the game is a margin compression one in this space for the most part. 0.25% in revenue for a slice of the ever growing, big index fund pie potential is better than not adding any funds to an active fund with a management fee of 2% given the fund flows of late.

- Firing a financial advisor to save 1% in fees can end up costing you more than 1% annually if you don’t know what you are doing, or are missing out on financial planning strategies not related to your portfolio.

- There’s no reason you can’t get active management cheaper with a mutual fund if that’s your cup of tea.

- Transparency is the key take-home point – you should know where all your money goes and you should be able to talk to your advisor about it so that your decisions are more informed ones.

- Fees really matter

Download the spreadsheet

If you haven’t yet, download a copy of the Microsoft Excel spreadsheet here: The Real Impact of Fees on Most Mutual Fund Investors.

The last statement is dead on: Fees really do matter. Your future nest egg is at risk if you over pay on the MER fees.

Yes, assuming you’ve got all your ducks in a row, fees really are important. More than most people realize.

Totally agree that fees matter, however, investors must keep in mind that investment professional have to make a living too. Life without investment management fees (MERs) would be utopia & all together unrealistic. Should Realtors not get paid for brokering house deals, or lawyers not get paid for critical business advice? Investment folks are professionals too, however, as clients, you must demand lower fees & more value from your Financial Advisor/Portfolio Manager. Ignorance to fees is no excuse just as ignorance is no defence when it comes to the law.

Hi Justin, thanks for your comment. What I meant by “having all your ducks in a row” was that one has a financial plan and investment policy statement and acknowledges whether or not they can handle their investments on their own or require the service of an advisor. With or without an advisor, all other things being equal, lowering fees is very important.

I think because there is an angst with some investors created by some bad advisors, too many people instantly assume that once you talk about fees, the discussion is framed in a context of being anti-advisor.

I actually think the vast majority of people need an advisor, which I think I’ve made pretty clear for anyone who follows my columns, blogs, and media quotes.

The salient point is that the mutual fund investor is not getting proportionate added value for this management expense. If you believe the studies, he is more likely to get a better return using low cost funds. I’m not sure about the impact of a financial advisor on overall performance (net of fees).

Thanks for the mention. I’m hoping that MERQ catches on. My guess is that many investors simply wouldn’t believe that their portfolios after 25 years would be only half as large as they could have been if not for expenses.

I think you’re right – so far, most people I’ve shown it to do not believe it.

Great article. Michael’s was equally good, I enjoyed the metric concept.

I can’t believe I invested in mutual funds for almost 10 years. Ugh. What a waste in my 20s.

No doubt fees kill (returns).

Thanks – the inspiration was Michael James’ MERQ. When his blog’s tagline is “I have an amateur interest in money. My goal is to explain financial matters clearly for non-specialists.” – he is bang on. One of my favourite reads.

One must be careful not to paint all mutual funds with the same ‘high fee’ brush. Like anything in life, if you do your homework, you can find low fee & strong institutional money management (look up Mawer, Bissett, or Matco on globefund.com (make sure to select the F series for Matco) as examples where MER range from 1-1.5%. This is much lower than the typical ~2.50% which I agree most definitely eat up returns over time. The key when looking for a Financial Advisor/Portfolio Manager, is to ‘go direct’ to the mutual fund manufacturers who offer their products direct often times with a potential for a relationship with one of their Portfolio Managers. This is the model we’ve built at Matco & I know the likes of Mawer & Bissett use as well.

If you’re so inclined to do your own investing, ETFs are a great option as well as MER can be 30-50% lower than direct manufacturing Mutual Funds.

Happy hunting for low fees.

I don’t think anyone disagrees that mutual funds have varying costs. But citing an F-class fund with an MER of 1-1.5% and comparing it to a typical 2.50% is disingenuous without discussing how they differ and how the costs of advice apply to F and non-F class funds.

Also ETFs are not reserved for DIY investors. There are many financial advisors who use ETFs to lower costs and charge 1% for advice and do a good job with financial planning and investment policy statements.

A good financial advisor is worth paying for, I’ve never argued that.

This is a great article. Not only does it show the cost of fees over time but is the only one I’ve seen lately that explains firing your advisor can cost you much more than the fees you save. You need to make sure your financial advisor is worth what you are paying them. I would like to see a comparison of the classic MER/trailer fee advisor vs a fee for service advisor with lower MER. My experience is you need at least $100,000 to $250,000+ for a fee for service advisor to take you on. What are young people supposed to do? No advisor and ETFs leave them susceptible to bad planning and less contributions.

Thanks Rick – the next update to the spreadsheet will indeed incorporate that along with a fee guide to give people an idea as to what the negotiable fee ranges are for each method of compensation.

Maybe more people will realize that picking an advisor is a really big deal, not to be taken lightly, given the costs. And also, I hope people are honest with themselves in terms of what they can accomplish without one.

When mutual fund and ETF returns are published, are these returns after fees or before fees?

Hi Greg, Michael James is right.

The normal answer is: ETFs and Mutual fund published returns are after MER. However he brings up some very good points about survivorship, incubation and other factors that the industry uses to game the look of returns.

@Greg: ETF and mutual fund returns are reported after fees, survivorship bias, incubation, and a host of other factor than affect reported mutual fund returns.

HI there. I am literally new this investment side of the world and started reading these PF blogs for sometime and following markets. I totally agree with MER being an big blow to investment but isn’t 2.69% on the very far end of fees scale? Since its being compounded over 25 years it seems to be huge. But I thought most funds with that high fees perform at a better rate than 5%. I know you have mentioned about low fees scenario too but some people are not comfortable in doing their own investments, same like growing their own food. Even ETFs are averaged around 0.5%

Hi Jatin, 2.69% is definitely high for a Canadian dividend fund that hugs the index, but there are higher ones out there as well.

There is no reason or proof to believe that a higher MER fund leads to a higher probability of beating an annualized return of 5% – in fact the opposite is true: lower fees are correlated with better fund returns.

What a timely find!! I’ve been harking about MER fees for a while and did a whole lot of calculations but you have put it all into perspective. Tomorrow (22 Dec.) I have a meeting with my financial advisor. I think a long discussion will ensue.

Only thing….I don’t have 25 years ahead of me. I would need a password so that I can tailor the spreadsheet to suit my personal situation.

Thanks a million Preet. I love to read your blogs. Keep up the good work. Maybe some day the mutual companies will get the message and wake up.

Thanks Michel – glad you liked it.

I’ll be putting together a more advanced spreadsheet which will allow for the customization of more variables in the near future – one of which will be the number of years to run the calculations.

Let us know how the meeting went.

If you use Google Documents, it will successfully convert the Excel spreadsheet for you and allow you to make changes.

What you are doing is wonderfully, but you have mistakes in your equation and theory.

1. (Equation)Not all funds will pay 1% trailer. There are funds that range from (.25-1.50%) Seg funds( the fees are higher). You are also not taking into account “F” class funds. If you care to read the canadian securities course, you will see that most investors should have bonds in their portfolio’s. Your portfolio is off.

2.(Theory Mistake)No one wants to get very sick, but if you can get treatment, would you spend the money to go to the USA and get the best help possible? Have you ever had a someone who has had cancer?

3. If you adjust your equation, and allow for a real situation. Example. Investor buys a fund, and looses 10 in the first year, and of course looses his 2%, then he pulls out money to buy a new car, decides he needs another $25,000 for the next house he buys. How much has he wasted? How often has this happened and will continue?

How about focusing on things that help investors. Such making sure you have a will in place, so that if you die, the life insurance goes to the intended person and not to the ex-wife. How about showing, how by not putting a “stop loss “on stocks can hurt your portfolio. Maybe if all those Sino Forest investors did that, maybe this christmas would be a little better off.

NOT upset, just wish you would help to make this a better place for all of us to live.

I know you will not publish this comment, because you like to focus on on only the positive and not the negative. I’m an advisor who tells everything( the good and bad) to my clients, and goes out of my way to help each client. I sleep very well at night, how do you sleep?, knowing your just showing one side and never telling the whole story.

“The Truth”, is not your strong suite, given the article you have written.

@Wish you would do better: To paraphrase Wolfgang Pauli, your comment is so bad it is not even wrong.

I hope you were kidding about being a financial advisor. Judging by your knowledge of segregated funds and pushing life insurance, I would say you are most likely a salesperson, not an advisor (and definitely not fee-only!)

While I don’t have the time nor the energy to address the dozens of mistakes (grammatical and factual) you made in your critique, suffice to say that:

No one speaks the truth more than Preet;

This was not an example of a complete portfolio, it addressed the effect of MERs on investor returns, can you read?

It was not designed to be an all-encompassing article about financial planning;

Couldn’t even comprehend what you were trying to say in Point 3 (or Point 2, for that matter);

I’m sure you do sleep well at night, Ignorance is bliss.

Preet is helping people, pay attention and you may learn something.

@Wish you would do better:

You are right in that Preet’s posts here on wheredoesallmymoneygo.com are aimed at helping people manage their investments and may not be as helpful with the basics of budgeting or planning. I am sure the people here can recommend other blogs, but even a quick read through David Chilton’s book covers the basics fairly thoroughly.

@everyone: I know it goes against blogging tradition, but be nice. It’s Christmas.

Just a question on how to operate the spreadsheet – if I do not have a financial advisor, can I just zero out the trailing commission and advisor payout? Thanks!

It depends. If you bought a fund that does not have a service fee, then yes you can zero out both. If you bought a fund WITH a service fee, but you don’t use an advisor, then just zero out the advisor payout. The discount brokerage might be taking the service fee.

“Service fee” is sometimes used in place of “Trailing commission”. There are many investors who buy the exact same funds that an advisor would offer through a discount broker and keep paying for advice without getting any.

Let me know if that is clear.

There are many e-series, d-series and f-series funds with reduced or eliminated service fees. Some investors are not aware.

@Preet Thanks for clarification, Preet. If I understand correctly, the spreadsheet assumes that the Trailing Commissions, Service Fees, and Advisor Payout are all contained in the MER and won’t impact the ‘Total Fees Paid’ amount.

Correct.

Hi Preet,

Thanks very much for speaking out on this subject. As your name and commentary has grown in the last few years, this message is getting to more and more people.

Comments like the ones from “wish you would do better” spell it out clearly. As for the “advisors have to be paid too” people, I agree in principle. But please, “fair payment”… not deliberately putting a client in products not suitable for them so they can collect ( a triple whammy) a front-load, high MER poor performing fund, and rear load to benefit themselves and lock the client in so they can’t get away when they realize they are being had. (without taking a further 5% hit)

When the average person sits in front of a person in a nice suit in their home bank or in one of our popular Canadian investment companies they expect the individual across from them is looking out for that client’s interest first.

I think we all know this is not the case many times. The “suitability standard” we use in Canada leaves the interpretation grey. So called “Financial Advisors” are picked for their marketing ability rather than their customer care ability. They don’t all even know themselves in some cases they are hurting more people then they are helping.

I find this subject facinating over the last few years and the reactions I get when I bring this subject up. I meet a lot of people, some of them in this industry, the comments and excuses I hear about these fee’s never cease to amaze me.

Hi Paul, thanks for your comments. The next 10 years are going to be very interesting indeed.